Official WeChat

Construction Materials Industry Prosperity Index (MPI) for July 2024 - Construction Materials Industry Slows in July

First. Construction Materials Industry Prosperity Index in July.

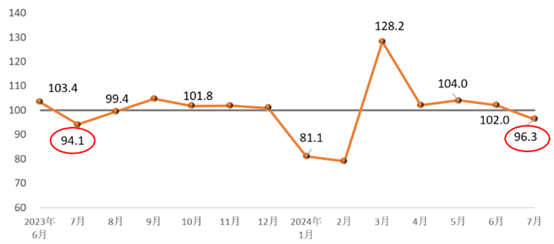

In July 2024, the construction materials industry boom index was 96.3 points, down 5.7 points from June, 2.2 points higher than the same month last year, lower than the critical point, in the non-boom zone, the industry's economic operation of the weak situation and seasonal factors superimposed on the pullback.

On the supply side, in July, the price index and production index of the construction materials industry were both below the critical point. Among them, the price index of building materials industry 99.8 points, 0.4 points higher than last month; the production index of building materials industry 96.6 points, 6.0 points lower than last month. Overall, building materials product prices fluctuated at a low level, the production slowdown is more obvious.

On the demand side, building materials investment demand index, industrial consumption index, international trade index are lower than the critical point. Among them, the building materials investment demand index 95.0 points, down 6.3 points from last month, the construction market demand weakened; building materials products industrial consumption index 99.9 points, down 4.9 points from last month, building materials industry chain upstream and downstream of the related manufacturing industry demand slowed down in a steady manner; building materials international trade index 98.0 points, down 3.4 points from last month, the building materials commodity trade appeared to pull back. Overall, the building materials market demand seasonal decline in July.

Second, MPI impact factor analysis and early warning.

Seasonal weakening of building materials market demand, building materials production slowed down. Affected by high temperature, rainfall and other seasonal factors, real estate, infrastructure projects and other investment areas of demand further weakened, building materials products involved in the industrial sector demand has weakened, building materials industry market demand fluctuations fall, building materials enterprise production slowdown. in July, in addition to lime gypsum industry, building materials, other industry production index is lower than the month before.

Product factory prices stabilized in low volatility, showing initial signs of bottoming out. in July, in the building materials industry, cement, concrete and cement products, wall materials, lightweight building materials, clay sand and gravel, construction stone, mineral fibers and composite materials, building sanitary ceramics and other 8 industries, product prices rose, product prices rose in the number of industries increased by 2 with the previous month, the overall show a low stabilization of a small upward trend. Trend. Since the second quarter, building materials products ex-factory price fluctuations downward trend gradually slowed down, cement and other key industry price downward trend has been suppressed, building materials product prices showed initial signs of bottoming out.

Supply and demand tends to weak balance, but uncertainties still exist. High temperatures, rainfall and other climatic factors on the construction and other market impact is obvious, building materials supply and demand synchronized fall, long-term supply exceeds demand market relations show marginal repair, tends to be weakly balanced. Weakening demand, coal and other fuel prices will further increase production costs and operating pressure on enterprises, while in view of the market oversupply of the fundamentals of the market has not yet improved significantly, the economic operation of the uncertainty factors still exist.

Notes:

1. Construction Materials Industry Prosperity Index (MPI) mainly monitors the operation trend of the construction materials industry, with a strong forecast and early warning effect; when MPI is higher than 100, it indicates that the construction materials industry is operating in the prosperous range, and when MPI is lower than 100, it indicates that the construction materials industry is operating in the non-productive range.

2. Construction Materials Industry Prosperity Index (MPI) judges the operation trend of construction materials industry from the supply side and demand side. The supply side is divided into price index and production index, and the demand side is divided into investment demand index, industrial consumption index and international trade index of building materials according to the actual impact of the demand field on the building materials industry.

3. The price index of the building materials industry reflects the trend of changes in factory prices of the building materials industry. The ex-factory price does not include the costs incurred in the circulation process of building material products, product profits and taxes. The factory price is different from the market price, the two changes will affect each other, there is a time lag, in a certain period of time there may be inconsistent trend of change.

4. the index of industrial production of construction materials, reflecting the trend of industrial production of construction materials, excluding price changes.

5. investment demand index, reflecting the trend of changes in investment market demand related to construction materials.

6. industrial consumption index reflects the trend of industrial consumption demand related to construction materials. Industrial consumption, including both inter-industry consumption within the construction materials industry and downstream industry consumption of construction materials products.

7. International trade index of building materials reflects the change trend of international trade of building materials, which is mainly composed of export index of building sanitary ceramics, building technical glass, building stone, glass fiber and composite materials, non-metallic minerals and other industries.